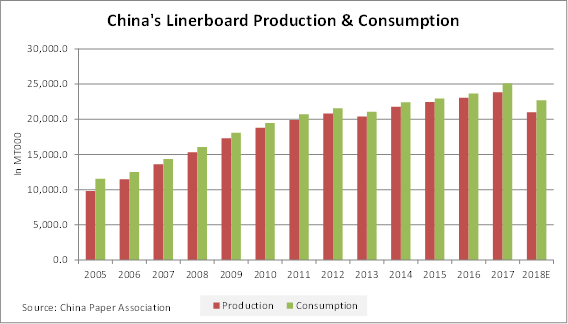

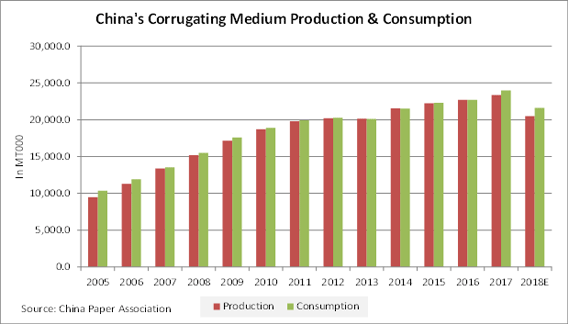

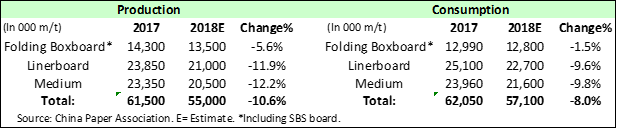

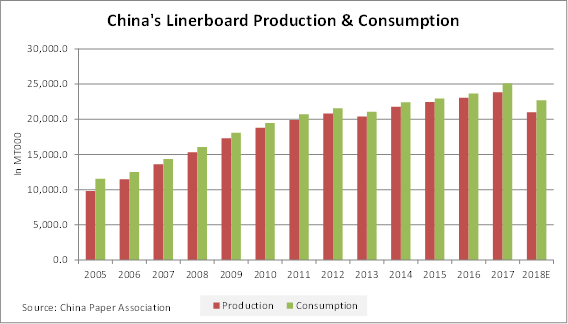

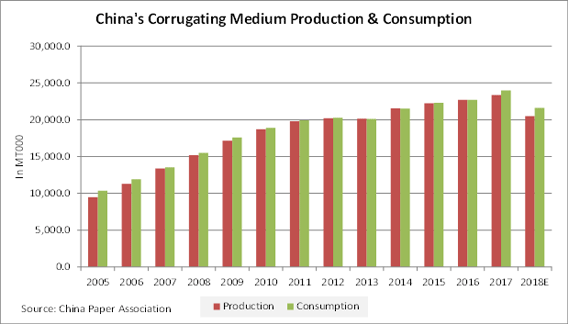

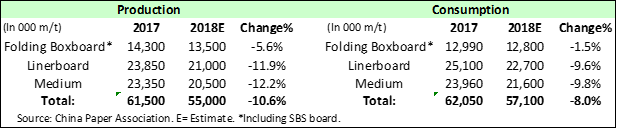

China’s industrial packaging paperboard industry, with containerboard in particular, turned from a robust start in the first quarter of the year to a standstill or even negative performance by the 3rd Quarter. Declines in demand beginning in the 2nd half of the year as a result of national economic slowdown in China and the tougher situation in fiber cost and supply, primarily recovered paper imports from USA that were under enhanced environmental scrutiny and punitive tariff in the trade disputes between US and China. Fully year 2018, China’s industrial packaging paperboard production was estimated to shrink more than -10% from the previous year, with consumption losing -8.0% at the same time, according to reports from China Paper Association (CPA).

Disappointedly, China’s containerboard industry suffered its first setback for years. CPA said the industry, which heavily relies on imports of recovered paper, was only availed of 17.40 million metric tons of import quota in the first three quarters of 2018. More adversely was of the fact that only 11.53 million metric tons were executed and delivered into China as a result of step-up environmental inspection at Chinese unloading ports. Hungry of supply, paperboard mills in China had to expand sourcing from the domestic market, which drove price of domestic OCC up significantly. And the economic slowdown in China from the 2nd half of the year also added pressure to the industry.